Entrepreneurs are the brain of any business, and they must know skills in accounting or marketing to run it effectively. They perform and wear multiple hats throughout the journey of a business. Being the owners of the firm, they cannot look to shy away from any responsibility, especially during the early stage when the manpower strength and available money to run the business is low.

Entrepreneurship is not just about conceptualizing the business model, choosing a brand name, designing the logo, and running of general day-to-day operations. Most business coaches and mentors would also scout for the importance of honing skills like leadership and communication. However, many tend to ignore a critical function – accounting.

Accounting is essentially a skill critical for entrepreneurs because it depicts how well a business is running. It is a way to showcase your efficiency and control over the business numerically. Even though unglamorous this function sounds, this is an essential activity to perform to run your business smoothly.

Accounting does not mean every entrepreneur has to be a master in accounting skills and standards or undergo formal training or professional certification like Chartered Accountancy (CA). All that needs is a strong base of fundamentals of accounting.

Fundamentals of Accounting Skills for Entrepreneurs

Fundamentals of accounting are fairly uniformly applied across the globe. Fundamentals refer to some basic concepts, and principles of accounting. Entrepreneurs with non-commercial backgrounds can quickly acquire them by going through this article and/or reading basic concepts freely available across the internet.

4 Key Terms of Accounting

- Asset – anything which you own and is expected to accrue benefits in future

- Liability – anything which you owe to others over both short and long term

- Expense – transactions where you pay money to purchase goods and/or services

- Income – transactions where you receive money to purchase goods and/or services

Golden Rules of Accounting

- Debit what comes in and credit what goes out

- Credit the giver and debit the receiver

- Credit all income and debit all expenses

Basic Accounting Concepts

Accounting of transactions is performed using below underlying concepts.

- Entity concept – The business’s identity is separate and distinct from its owners and promoters.

- Money measurement concept – Record only those transactions which can be measured in terms of money.

- Periodicity concept – Prepare accounting records and statements for every year of existence.

- Accrual concept – Record transactions as and when they occur (not when cash is exchanged), and in the period they relate to.

- Matching concept – Record all related revenues and expenses of a transaction.

- Going concern concept – Underlying assumption that business will continue operation in the foreseeable future.

- Cost concept – Determine the value of the asset based on historical/acquisition cost.

- Realization concept – Any change in the value of an asset is to be recorded only when realised.

- Dual aspect concept – Every transaction has two aspects, i.e., impacts one asset, liability, income and/or expense account.

- Conservatism – Refers to accounting for all future losses but without recording future income.

- Consistency – To achieve comparability of the financial statements over time, the accounting policies should be consistently followed.

- Materiality – If the impact/effect is not considered material, it may be ignored.

Basic Accounting Assumptions

Below three concepts are fundamental assumptions to accounting which have to hold true under all circumstances, failing which there would be no proper accounting.

- Going Concern

- Consistency

- Accrual

Benefits

There are so many valuable aspects of accounting work, but these benefits deserve special attention:

- Mastery over numbers – Knowing numbers related to your business should be at the back of the fingertips of all entrepreneurs. Basic numbers like revenue, balance sheet size, gross profit margin, and net profit are key to any financial discussions. The inability to recall these basic numbers can result in embarrassment in business meetings.

- Financial decision making – As owners of the business, an entrepreneur’s decision largely shapes the business’s future. To ensure a smooth sail, an entrepreneur’s decisions need to be financially sound, not just based on gut feeling.

- Future planning – Accounting skills are required by entrepreneurs in every stage of business. Proper accounting helps you navigate vital business metrics like forecast revenues and profitability, required debt, probable tax outflow etc. With these numbers, an entrepreneur can plan for a brighter future.

- Effective communication with the accounting team – Accounting policies vary across businesses and are framed based on management’s views, goals, and objectives. Hence, to create and follow an effective, consistent accounting policy, even an entrepreneur needs to be aware of fundamentals so everyone is aligned with business goals and objectives.

Essential Accounting Skills for Entrepreneurs

Having understood the fundamentals and benefits of accounting, we will now dwell upon the top 9 accounting skills essential for any entrepreneur. Good knowledge of these skills would go a long way in helping to be aware of your business’s current state of affairs.

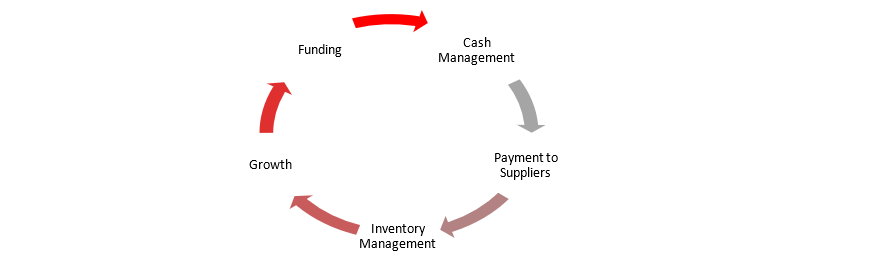

- Cash Flow Management – is an evergreen quote to stress the importance of having this asset. The unavailability of this asset can mean the closure of your business, both in the short and long term. Hence, it becomes vital to monitor, track, and manage your cash flows effectively. For entrepreneurs who start with limited capital and support, cash is the lifeline of your business. It is the oxygen that your business always needs to survive. Without cash, businesses fall under the vicious circle of living life at the edge, i.e., inability to pay suppliers/creditors leads to a lack of inventory, leading to a lack of growth which translates into lower funding and valuation – refer to the below image for the cycle of cash management and its dependent flows.

Revenue is vanity, Profit is sanity and Cash is KING – Alan Miltz

- Balance Sheet Management – Balance Sheet is like a report card of your business which gives an instant view of the financial health of your business. Knowledgeable investors study this statement very minutely to understand the current state of affairs. On the one hand, it shows the total assets owned by your business and on the other hand, shows money owed to lenders, suppliers, and creditors. It will easily reflect how a business is being run – whether it’s run-on credit or on a healthy cash basis. For example, generating higher turnover looks good on the income statement. Still, a corresponding increase in the borrowers/debtors signals that the value of sales is not being realized in cash, and there runs a risk of customer default. Again, the investors do not just focus on the assets side. Keeping a constant check on the growing list of lenders/creditors is equally important to ensure long-term success.

- Profitability – Profit, commonly referred to as Income, means the net value of money left over from total sales/revenue after deducting all your expenses and taxes. This statement shows if you are actually making any money from conducting this business or if you are eroding capital and investors’ wealth. Although the first metric to be seen in any business is revenue/turnover; however, seasoned investors are equally keen on seeing this number. Not everyone can start a profitable business and thus may incur losses to create market demand, acquire customers, etc. However, these losses cannot continue forever, for money in the bank will soon dry out, and one may have to close down their dream – business.

- Projections – Nobody knows the business better than an entrepreneur. They are in the driver’s seat to plan, forecast and make projections of the future directions and path of the business. A projection of where the business will stand in the short-term and long-term indicates how well an entrepreneur is involved in the business. Projections about sales, cash flows, profitability, and inventory are KPIs for any business.

- Know the latest updates

It’s important to stay current on the latest accounting laws and regulations. Not only will this improve your accounting skills, but it will also ensure that you file your reports correctly and without mistakes. To ensure you are well-informed, it’s a good idea to consult with accounting professionals when preparing your reports. To stay relevant, you can also enrol in various accounting certifications such as ACCA, US CMS, and US CPA.

- Inventory Management – Business is an act of providing/selling a good/service. Having sufficient inventory ensures you can meet the demands of the market and customers. To meet this demand, an entrepreneur must be aware of the inventory turnover ratio to effectively manage working capital.

- Expense Management – Effectively tracking your expense helps avoid unnecessary expenses. Although an entrepreneur may not track daily expense vouchers, knowledge of expense management can help keep effective checks on this daily, small but cash-linked area of business.

- Tax Obligations –It’s a myth that tax-related obligations and payments arise only when you profit. Most laws across jurisdictions require businesses to report their state of affairs periodically and pay taxes on selling goods/services. Without fulfilling these basic obligations, businesses might have to endure unnecessary, time-consuming trips to tax departments and pay hefty fines, and penalties. Payment of such fines and penalties would be an additional burden and must be avoided at all costs.

- Distinguish between Fixed & Variable Costs – Understanding the difference between fixed and variable costs is key to determining the selling price of your good/service. Variable costs plus desired margin result in the price to be charged, while fixed costs should not be considered. Fixed costs are immune to sales volume and are expected to remain the same over a period of time. Costs like rent, insurance premiums, and interest payments are examples of fixed costs. On the other hand, variable costs are directly proportional to the sales volume achieved and play a huge role in unit economies of scale. Examples of variable costs include direct labour, raw materials, and logistic expenses.