Most startups require funding to expand their operations, products/services, teams, etc. However, to obtain this funding, a startup must first determine the amount of money needed to approach these investors and disclose the value of their company. And this is where startup valuation comes into play.

However, founders frequently struggle to define valuation, particularly in the early stages, because the company’s ultimate failure or success is unknown. As a founder, you should also become familiar with business communications best practices so that you can communicate the value of your startup to an investor in a concise manner.

In this article, we’ll look at the 9 most common startup valuation methods used by investors and prepare you for future fundraising talks.

9 common startup valuation methods

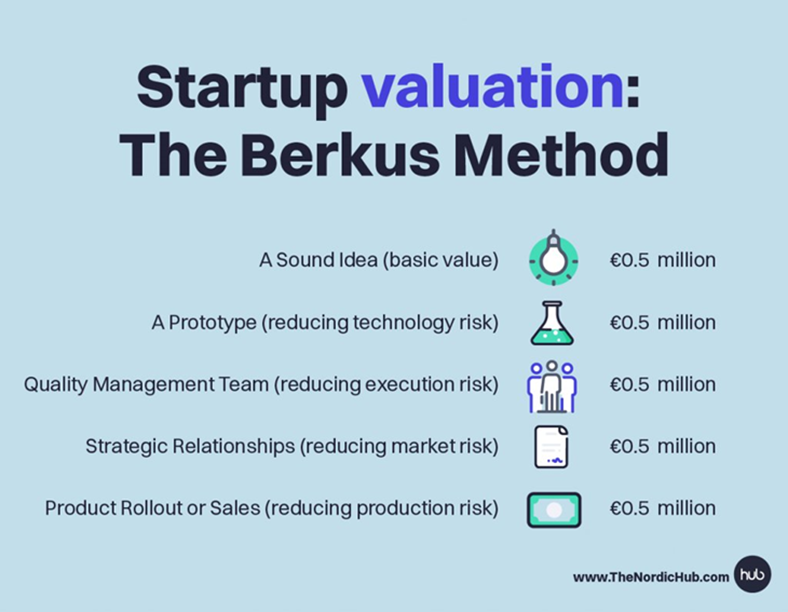

1) Berkus method

The Berkus method is a valuable tool for pre-revenue startups because it allows them to quickly assign value and compare their company’s qualities to others to see what opportunities are available. The method bases its measurements on the startup’s concept by evaluating the following values:

This provides investors who want more information about these aspects with an easy way to evaluate companies that have not yet made money or established themselves sufficiently in the industry.

2) Scorecard valuation method

This method is a novel approach to determining the worth of your startup. You can weigh different aspects of its worth by comparing it to other startups in the same field or region. You could use categories like management team strength or marketing efforts.

Each category is assigned a comparison percentage that can be less than, equal to, or greater than 100%.

For example, imagine that a tech company employed a few Gen Z’s because they needed a fresh perspective to take on some new marketable technology and they’re on the verge of revolutionizing the industry; the company may receive 100% for being on par.

3) Book value method

The book value method associates the net worth of your startup company with its valuation. Because a startup’s book value equals its total assets minus liabilities, the book value method, also known as asset-based valuation, can be calculated by taking the company’s total equity and dividing it by the number of shares outstanding.

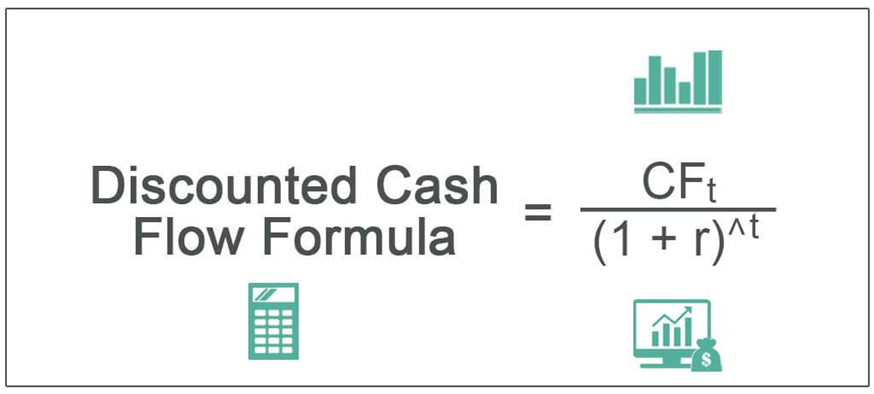

4) Discounted cash flow (DCF)

This method is ideal for new businesses because it values an enterprise based on its future potential rather than its current performance. It accomplishes this by calculating the cash flow’s value using an expected investment return rate.

Imagine you establish a digital innovation hub, and you have the ability to transform the company into a thriving corporation. In that case, it’s safe to say your startup has enormous future potential, which the DCF valuation considers.

However, DCF analysis is only appropriate in situations where a person is paying money in the present with the expectation of receiving more money in the future. For example, assuming a 10% annual interest rate, $5 in a savings account will be worth $5.5 in a year. Similarly, if a $5 payment is postponed for a year, the present value is $4.5 because it cannot be transferred to a savings account to earn interest.

Here’s a formula you can use to calculate your DCF valuation. When using the DCF method, you must discount the value of future earnings to what they would be worth today. This is because there is always the possibility that future revenue streams will not be realized.

Another limitation of the DCF method is that it relies on an analyst’s ability to accurately predict future market conditions. The analyst must then make reasonable assumptions about long-term growth rates.

5) Market multiples

Market multiples can be a good valuation method for startups if there isn’t enough money coming in yet.

When you use the market multiples method, you’ll compare the value of your startup to recent acquisitions of similar businesses in the market. This approach is popular among venture capitalists because it gives them a good idea of what the market is willing to pay for a company.

Assume a fictional softphone solution startup wishes to conduct a valuation in order to persuade investors and raise funds. Potential investors will almost certainly wonder, ‘what is a softphone?’ and will most likely conduct some market research to fill information gaps.

You also conduct some competitive research and discover that similar softphone companies are selling for four times their annual gross revenue. Knowing what investors are willing to pay for similar softphone businesses allows you to also use a ‘four times’ multiple to value your company.

However, you may want to play around with these figures a little to account for circumstances specific to your business. For example, if your company was further along in the development process than most, you would multiply by five.

The issue with this method is that comparable market transactions can be difficult to find because many early-stage businesses keep their deal terms confidential.

6) Customer-based corporate valuation method

Startups use the customer-based corporate valuation method because it’s more diagnostic and accurate than traditional models. It also incorporates the most important determinants of corporate valuation (customer acquisition, retention, and monetization) directly into the valuation model.

Imagine you run a consulting firm and offer customers advice on how to set up affiliate programs.This approach will value your company by utilizing sophisticated predictive customer analytics to determine how well your company is acquiring new customers as well as retaining and monetizing existing customers.

It then enters this data into a standard discounted cash flow valuation model to generate an estimate of your company’s overall valuation.

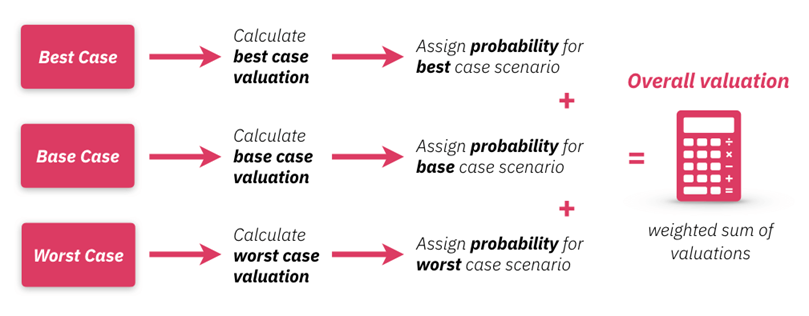

7) First Chicago method

This approach is a two-step valuation method that employs both the DCF approach and the comparable multiples method.

It generates financial forecasts using the best case, base case, and worst-case scenarios and then employs the comparable multiples method to arrive at the estimated terminal value for all scenarios.

Each scenario is then assigned a probability, and the value is the weighted average of all events. The First Chicago method informs investors of both the company’s advantages and the risks of investing in it.

8) Comparable transactions method

The Comparable Transactions Method is one of the most widely used startup valuation techniques because it’s based on precedent. You’re responding to the question, ‘How much have startups like mine been acquired for?’

For example, imagine you came across a tech startup website similar to yours on Stack Overflow and did a little research on it, and discovered it was acquired for $35 million. Its mobile app and website had 900,000 users. That equates to about $39 per user. Assume your startup has 170,000 customers. This gives your company a market value of around $6.6 million.

However, it’s important to note that transactions from a long time ago may no longer be relevant for analyzing your company in today’s market, and if the two deal sizes are significantly different in valuation, they may not be a viable comparison.

9) Risk factor summation method

The risk factor summation method estimates the value of a startup by taking into account all business risks that may affect the ROI of the investors. For the valuation of your company, the RFS method employs a comparable startup’s base value. This baseline value is then adjusted for 12 common risk factors.

Each risk is then assessed as follows

- +2 very positive

- +1 positive

- 0 neutral

- -1 negative

- -2 very negative

The average pre-money valuation of pre-revenue companies in your region is then increased by $250,000 for every +1 (+$500K for a +2) and decreased by $250,000 for every -1 (-$500K for a -2).

For example, imagine you run a CRM software company and the average pre-money valuation of pre-revenue companies in your area is $2.5 million.

If your assessment of the twelve factors listed above contains four neutral assessments (0s), six (+1’s), one (-1), and one (-2). The total will be $750,000, which will then be added to the average valuation of $2.5 million to arrive at a pre-money valuation of $3.25 million.

The best practice is to use a combination of at least three startup valuation methods. If all three methods produce roughly the same result, consider taking the average of the three. If one is an outlier, average the other two or use the fourth method to get three of them to agree.

Measuring value

As the founder of a startup, you require a valuation estimate that you can justify to potential investors and rely on for any other reason. A precise valuation assists you in developing your long-term capital raising strategy and keeping your funding requests in context.

It’s also important to consider whether you operate in a market where the number of business owners vastly outnumbers the number of willing investors. If this is the case, your startup valuation will suffer. In such a competitive environment, many business owners are desperate for investment and may even sell themselves short to do so.

On the contrary, let’s imagine a fictional phone system startup that came up with rare patented ideas for phone.com alternatives that have been making waves in the industry. This could increase investor demand, making the startup more valuable.

Furthermore, no single startup valuation method is always correct. You’ll most likely use a variety of methods and techniques to arrive at a reasonable price. Don’t forget to use company databases to ensure you’re in the right ballpark. If you’re new to the startup world, it’s also worth familiarizing yourself with the startup’s urban dictionary, as it can help you avoid future problems.